Blinkit just hit a snag. The quick commerce giant has paused accepting stock from new and pre-launch brands until October 31 due to the festive rush and warehouse disruptions across Delhi, Haryana, Mumbai, and Bengaluru. So, what’s really happening at Blinkit?

Stuck In The Festive Gridlock: Disruptions have hit at the worst possible time – Diwali, when sales peak. Transitioning to an inventory-led model in September left Blinkit just weeks to scale warehouse capacity before festive demand hit. As a result, the company’s major supply hubs couldn’t absorb both the model transition and seasonal spike simultaneously.

Sellers In Turmoil: While Blinkit officially described the disruption as a planned procedure, the logistical chaos created significant issues for sellers, especially smaller brands. Many vendors were unable to list their Diwali products on Blinkit, with inventory dispatch slots to the quick commerce giant’s warehouses stretching beyond a week.

This not only meant a loss of sales but also a missed opportunity to establish a market presence during India’s most lucrative retail period.

The Fallout: The operational paralysis, even if ‘temporary’, comes with big implications. Halting new product intake for a month means a direct hit to quarterly revenues, strained seller relationships, a lacklustre assortment of products and investor scrutiny. The shaky handling of a predictable surge also raises questions about the scalability and robustness of its new inventory-led model.

Blinkit’s Profitability Question: This operational stumble comes at a delicate moment. While Blinkit’s revenue growth has been explosive, soaring 2.5X YoY to INR 2,400 Cr in Q1 FY26, even outshining parent Eternal’s core food delivery business, the company reported a loss of INR 42 Cr during the period. The disruption is expected to have a further impact on the company.

With that said, even as Blinkit is racing to 2,000 dark stores, its festive stumble shows growth is hitting a wall.

From The Editor’s Desk Tracking Tata 1mg’s Full-Stack Journey

Tracking Tata 1mg’s Full-Stack Journey - Tata 1mg is on course to become a full-stack healthcare platform offering medicines, diagnostics, and e-consultations, both online and offline, to capture India’s $38 Bn outpatient market.

- The shift from a marketplace to an inventory-led model, owning its supply chain and setting up NABL-certified labs has enhanced margins, ensured product quality, and allowed entry into high-margin speciality pharma and diagnostics, strengthening consumer trust.

- With 180+ retail stores functioning as both pharmacies and dark stores, and plans to expand to 500 by FY26, Tata 1mg is combining offline presence with quick commerce capabilities — but rising costs and competition from Apollo, PharmEasy, and Netmeds will test its scalability and service consistency.

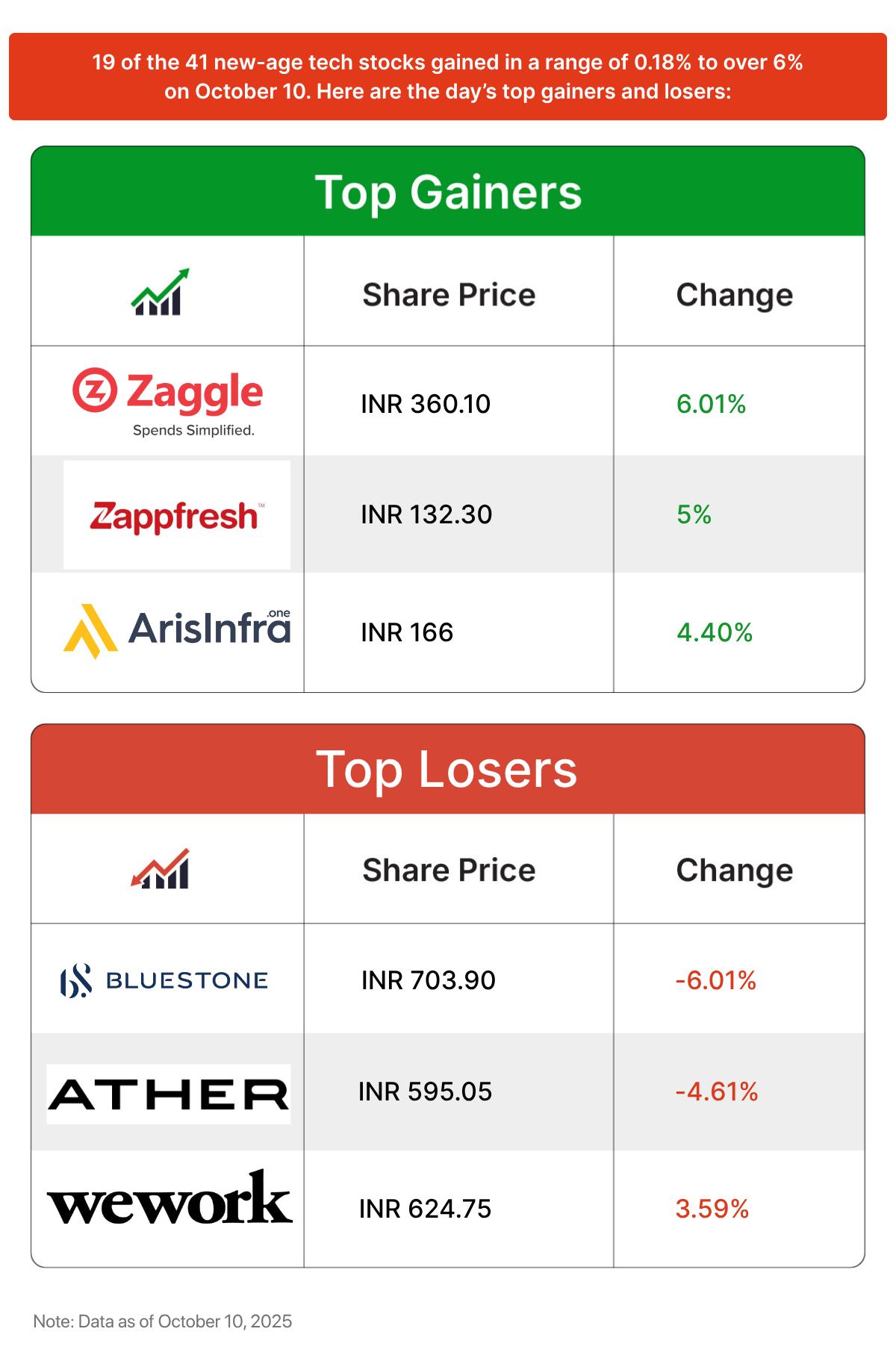

- Twenty-three out of the 41 startup stocks under Inc42’s coverage ended last week in the green. While TAC Infosec gained the most, the newly listed Urban Company emerged as the biggest loser.

- Buoyed by the World Bank’s upward revision of India’s FY26 GDP growth forecast, easing geopolitical tensions in the Middle East, and optimism around India-US trade discussions, BlackBuck, Eternal, BlueStone and Smartworks touched record highs.

- However, markets are expected to react sharply as all eyes shift to domestic inflation data and the Q2 FY26 earnings season next week

A New Blow To WazirX

A New Blow To WazirX - The Bombay HC has dismissed an appeal filed by WazirX’s operator Zanmai Labs against an arbitral tribunal order, which directed the troubled crypto exchange to provide bank guarantees worth INR 45.38 Cr to rival CoinSwitch.

- CoinSwitch had challenged Zanmai’s move to freeze its assets last year after a hack, arguing that their agreements did not authorise the WazirX operator to “socialise” its losses across all users.

- WazirX has been in the middle of a storm ever since hackers stole $235 Mn worth of crypto assets from its multi-signature wallets in July last year.

A Good Week For Startup Funding

A Good Week For Startup Funding - Indian startups cumulatively raised $284.6 Mn across 26 deals last week, up 78% from $160.3 Mn raised across 14 rounds in the preceding week.

- Dhan topped the charts with its $120 Mn fundraise and became India’s 125th unicorn. Intangles came a distant second as it took home a cheque of $30 Mn, while Qapita Fintech notched up a $26.5 Mn Series B round last week

- AI startups led the deal count with six ventures bagging $24 Mn. Accel, Claypond Capital and DeVC were the most active investors last week.

Anthropic Makes India Its Next AI Frontier

Anthropic Makes India Its Next AI Frontier - Following OpenAI’s Sam Altman, Aravind Srinivas of Perplexity and Microsoft CEO Satya Nadella, Anthropic cofounder and CEO Dario Amodei met Prime Minister Narendra Modi in New Delhi last week.

- This comes as Anthropic plans to set up its first India office in Bengaluru by early 2026, hire a country head and set up a local team. It is also ironing out a potential partnership with Reliance, training nine Indic language models and building India-centric use cases.

- Flush with recent $13 Bn funding, Anthropic wants to corner a big pie of the country’s growing AI market, especially startups and developers. India is the company’s second-biggest market by usage globally, after the US.

India’s quick commerce space is booming. Yet, for both new entrants and established brands, the high costs, logistical complexities, and technological demands of building and running a dark store network are significant barriers to entry and expansion. This is where Inamo steps in.

A Full-Stack Q-Comm Solution: Founded in 2024, Inamo tackles this problem by offering a comprehensive, outsourced solution for dark store operations. Instead of building from scratch, companies can plug into Inamo’s full-stack service, which covers everything from warehouse management and order fulfilment to last-mile delivery.

Tech-Powered Optimisation: At the heart of the startup’s offering is a proprietary software stack designed to optimise every aspect of dark store operations – real-time inventory tracking, order routing, and delivery fleet management. Inamo’s “infrastructure-as-a-service” model helps brands enhance efficiency, reduce delivery times, maintain higher driver standards and bypass operational complexities.

The startup currently claims to operate and enable over 50 dark stores with a dedicated last-mile fleet across six major metros. Backed by Shastra VC and Antler India, can Inamo power India’s quick commerce revolution?

The Indian startup ecosystem, already boasting 70K startups and 125 unicorns, is preparing for its next major growth phase with 67 emerging “minicorns.” Who will hit billion-dollar status next?

![]()

The post Blinkit’s Operational Chaos, 1mg’s Full-Stack Sprint & More appeared first on Inc42 Media.

You may also like

Mahagathbandhan's boat stuck midstream, it will sink: JD(U)'s Rajeev Ranjan on Bihar polls

Chris McCausland admits 'it broke me down' as he talks true cost of winning Strictly

Human bones found on Saunton Sands beach as cops cordon off scene

BREAKING: Jack Wilshere appointed as Luton Town manager after turning down Arsenal return

Union Health Secretary inaugurates CPR Awareness Week; underscores lifesaving importance of CPR for every citizen