Last week, the Trump administration imposed a steep $100K (nearly INR 90 Lakh) annual fee on foreigners working in the US on H-1B visas.

With Indians accounting for over 70% of all H-1B visas issued last year, is this the end of an era for Indian talent in the United States, or the start of something new?

American Dream Sours: The exorbitant fee hike is expected to take a hit on onsite hiring for entry-level Indian professionals and create massive corporate implications. Companies like TCS, which had 5,505 H-1B approvals in 2025, and Amazon, with over 10,000 such visas, face potential annual costs in the hundreds of millions.

Will Startups Get A Boost? While the policy aims to curb immigration, it may unintentionally trigger a “reverse brain drain” that benefits India’s startup ecosystem. With the US becoming prohibitively expensive, top-tier talent, which would have otherwise moved abroad, would fuel innovation within domestic ventures.

Riding The GCC Dark Horse: With cities like Bengaluru, Hyderabad and Pune ready to absorb this wave of talent, industry insiders see the restricted mobility driving multinational corporations toward greater reliance on global capability centres (GCCs) and IT service firms in India. The reason: India’s cost advantage, deep expertise and a vast talent pool.

As the US implements what critics are calling a ‘wall against global talent’, will this visa fee hike transform India into a global innovation hub, or will it merely create short-term disruption before companies adapt to the new economic reality? Let’s find out…

From The Editor’s DeskJar’s FY25 Revenue Pot Sweetens: The wealthtech startup claimed that its revenues zoomed 3.2X YoY to INR 208 Cr in FY25 while losses (before ESOP expense) declined 50% YoY to INR 35.3 Cr. It also claimed to have achieved profitability in the first two quarters of 2025.

Mixed Week For Startup Stocks: Of the 37 new-age tech stocks under Inc42’s coverage, 18 ended last week in the black. The remaining stocks declined in a range of 0.22% to over 8%. Swiggy emerged as the biggest gainer while Yatra ended the week as the biggest loser.

A Great Funding Week: Indian startups cumulatively raised $316.6 Mn across 23 deals last week, a near 7X jump from $47.8 Mn raised in the preceding week. Infra.Market and EvoluteIQ topped the charts by raising $83 Mn and $53 Mn, respectively.

Google’s 2025 AI Cohort: The tech giant has selected 20 startups as part of the second cohort of its “AI First” accelerator programme. Chosen from more than 1,600 applicants, the selected startups span segments such as agentic AI, LLMs and responsible AI solutions.

Dawn Of The TPU Era: As AI demand soars, TPUs are emerging as powerful GPU alternatives, promising faster processing and lower energy costs. But with NVIDIA’s dominance and India’s limited access, can TPUs truly reshape the country’s AI future?

Swiggy’s Unbundling Spree: Amid much fanfare, Swiggy launched ‘toing’ last week to offer “affordable” meal options to GenZs and young professionals in Pune. But critics see this model of rampant app launches further hampering Swiggy’s long-term profitability.

How Startups Fared In FY25? Sixty-two new-age tech companies clocked an operating revenue of INR 2.33 Lakh Cr in FY25, up 18.2% YoY. While 24 reported a total net loss of INR 14,163.9 Cr, the remaining 38 posted a cumulative net profit of INR 7,831.66 Cr.

Listed Startup Tracker: Over 40 Indian new-age tech companies have listed on the exchanges, accounting for a total market capitalisation of $110 Bn. Fintech leads the charts with eight public listings, ecommerce is close behind with seven IPOs.

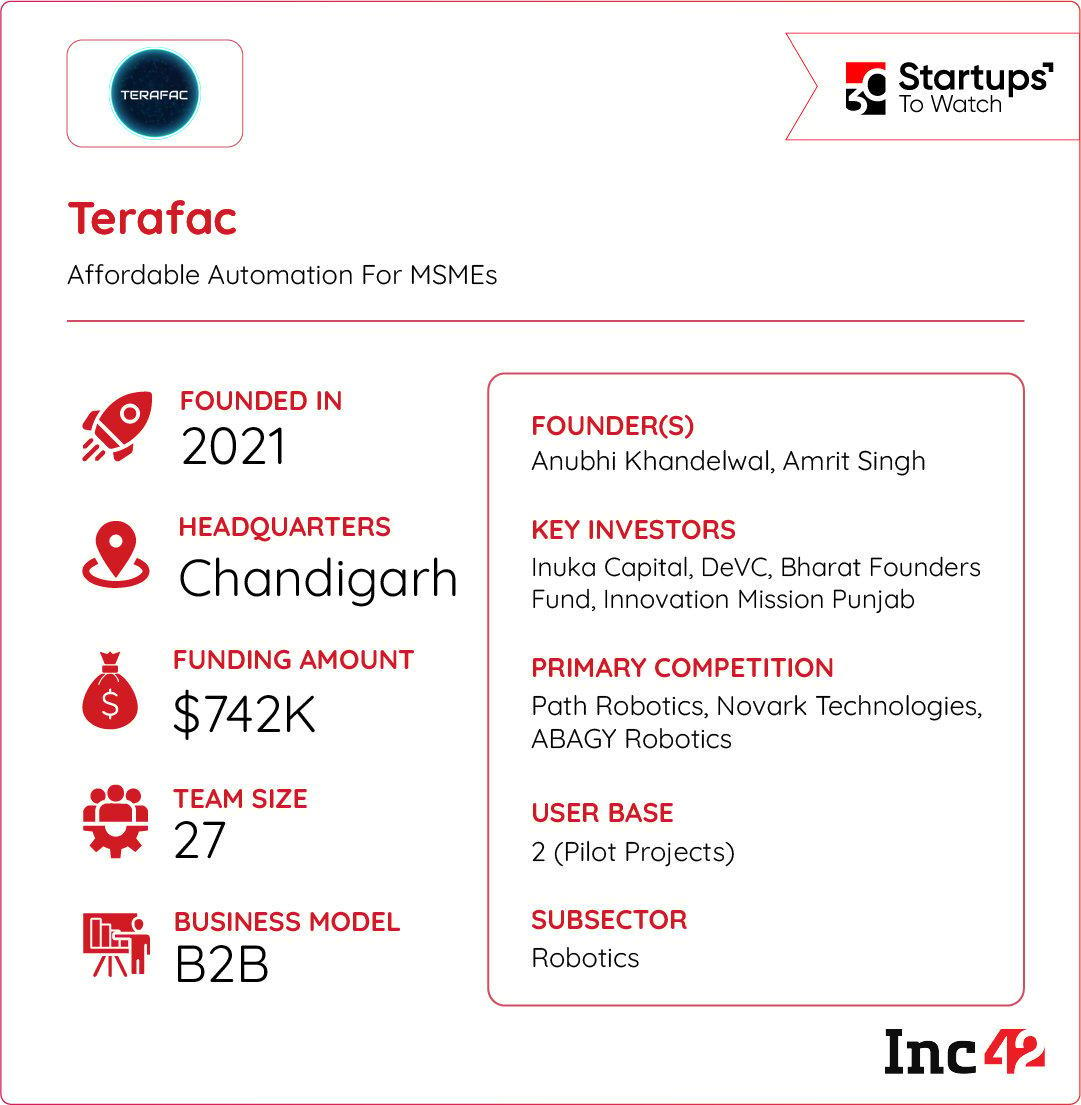

Inc42 Startup Spotlight How Terafac Is Making Automation Affordable For MSMEsIndia’s manufacturing sector remains trapped in the pre-Industry 4.0 era, with the traditional robotic automation proving prohibitively expensive and technically complex for small enterprises. Mohali-based Terafac wants to change this.

Making Robots Autonomous: Founded in 2021, the startup leverages AI and computer vision technology to transform standard industrial robots into intelligent, self-adjusting systems. Its flagship product, WeldT, enables off-the-shelf robots to perform multiple functions such as welding, painting, inspection, and assembly at reduced costs.

The Cost Advantage: Operating on a SaaS model, Terafac targets India’s vast SME manufacturing base that seeks affordable automation solutions. It claims to offer 4X productivity gains with minimal technical training.

Faced with challenges such as proving reliability at scale and competing against established giants, can Terafac democratise industrial automation for SMEs?

The post Trump’s Visa Blow To Indian Tech, Jar’s FY25 Pot & More appeared first on Inc42 Media.

You may also like

'Ronaldinho said I can win Ballon d'Or without a doubt - but at Man Utd I had no chance'

Untold Story of PM Modi: Stars participate in a musical program based on the life of PM Modi, watch the video

'Selfless' son saves four lives donating organs after suddenly dying at home

CEO weighs himself daily, wears the same shirt, pant, socks and even shoes in office daily. Here is his logic

"Slashing GST rates will definitely bring down prices of goods by 15-20 per cent": CAIT